First Responder Union Leaders Need to Know: About the Financial Urgency Law

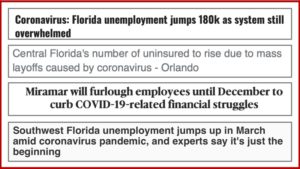

As governments continue to deal with its effects, there are concerns about the financial impact of this Covid-19 pandemic on local government funding over the next several budget cycles. Depending on how your employer and your department receive their funding, the economic downturn and rising unemployment could impact on county, municipal and public safety budget planning that will be underway for the upcoming fiscal year.

The longer this economic downturn continues, the more likely it is that elected County Property Appraisers will feel the need to lower the taxable value of both residential and commercial properties throughout Florida. If your employer or department receives funding through property taxes, decreasing property values may impact you. Even if your department receives its funding from some form of user fee, the economic downturn could leave property owners unable to pay the fees on time (or at all) leaving local governments with tough choices to make at budget time. Finally, local governments that receive some (or a majority) of their funding through the operation of local utilities or from local sales taxes may also see decreasing revenues caused by widespread unemployment.

When local governments face true financial hardship, Florida Law provides a process for those governments to get themselves out from under the financial obligations of their existing collective bargaining agreements. The law in this area developed after the Great Recession, ultimately being decided by the Florida Supreme Court.

Before your local government provides you notice that they plan to declare a financial urgency under this law, prepare your Union to respond.

The part of Florida Statutes addressing financial urgency is Section 447.4095:

Financial urgency. In the event of a financial urgency requiring modification of an agreement, the chief executive officer or his or her representative and the bargaining agent or its representative shall meet as soon as possible to negotiate the impact of the financial urgency. If after a reasonable period of negotiation which shall not exceed 14 days, a dispute exists between the public employer and the bargaining agent, an impasse shall be deemed to have occurred, and one of the parties shall so declare in writing to the other party and to the commission. The parties shall then proceed pursuant to the provisions of s. 447.403. An unfair labor practice charge shall not be filed during the 14 days during which negotiations are occurring pursuant to this section.

This law was designed to allow local governments a process to address and modify financial obligations called for in an existing collective bargaining agreement when a serious unforeseen financial shortfall develops during the term of that agreement. But, the Florida Supreme Court ruled in 2017 that before an employer can utilize this section of Florida Statutes to alter the financial terms of an existing bargaining agreement it “must demonstrate no other reasonable alternative means of preserving its contract.”

Assuming no other reasonable alternative means of preserving the contract exists, the process calls for the declaration of “financial urgency” to be made to the Union. Thereafter, a 14-day period of collective bargaining opens for the Union and employer to attempt to negotiate a resolution to the impacts associated with the financial urgency. If, after 14 days of bargaining, agreement cannot be reached, then an “impasse” will be deemed to have occurred. The statute then calls for the parties to proceed under the normal impasse procedures, including: 1) notification to PERC of an impasse, 2) selection of a Special Magistrate, 3) a hearing before the selected Special Magistrate, 4) the acceptance or rejection of the Special Magistrate’s recommendations for resolving the impasse and 5) if recommendations are rejected, a public hearing before the legislative body of the local government. The Union can file an unfair labor practice charge after the 14 days of negotiations.

The Florida Supreme Court also ruled that mid-term changes sought by the employer through the announcement of a “financial urgency” cannot be implemented until the complete statutory impasse process has been exhausted.

So, what can or should Union officers and leaders do now?

- Make sure the Union and its negotiation team members have a complete understanding of how their government employer, and more specifically their department, is funded.

- Unions should examine the government employer’s annual audit known as the comprehensive annual financial report (CAFR) which is the year-end financial statement that illustrates the true financial health of the government. Some national Unions provide a service to assist their local affiliates with summarizing the information contained in the lengthy CAFR. Donnelly + Gross also assists its Union clients with reviewing and evaluating the annual CAFR upon request.

- If a financial downturn is on the horizon, Unions are encouraged to develop contingent plans and proposals well ahead of bargaining that will help the government address their financial shortfall while causing the least amount of impact to bargaining unit members.

It is our sincere hope that no local Union is faced with a declaration of financial urgency. However, if a financial urgency declaration is made, the Union’s preparation coupled with support from the Union’s legal counsel will be essential to getting through the process.

We continue to closely monitor the situation and update this information to provide the latest workplace and legal developments related to Covid-19. For answers to your specific questions and for the newest developments, please visit our website at www.donnellygross.com/covid-19-resources/ and contact us at Donnelly + Gross at 352-374-4001 or directly by email:

Paul Donnelly paul@donnellygross.com

Laura Gross laura@donnellygross.com

Jung Yoon jung@donnellygross.com

Jim Brantley jim@donnellygross.com

Cole Barnett cole@donnellygross.com

We are here to support you.

DONNELLY + GROSS